The global EV boom is a boon for a number of people. Battery makers, microchip suppliers, stockholders and more have made big bucks off the move to electrified vehicles. It even, albeit briefly, made Elon Musk the richest person in the world.

But Tesla, for all its faults, is a real company. It has employees and machines that build cars you can buy. The company’s stock price may be unmoored from its earnings or potential earnings, but the company and its products exist. It sells cars and earns money.

One would think that other companies, that don’t make cars, probably don’t make any money for anyone either. Strangely, that doesn’t seem to be the case. How does it work? I dusted off my business major hat, dove into the SEC paperwork, and tried to figure that out.

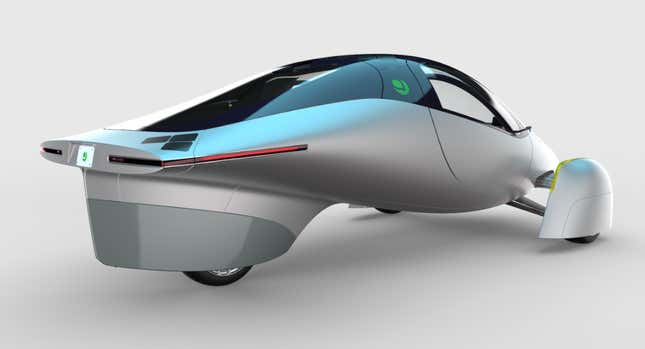

Aptera

The Aptera is a lightweight, three-wheeled electric vehicle claiming up to 1,000 miles of range and 40 miles per day of solar charging. While it isn’t legally a car, according to the company’s FAQ, it can be driven with a regular driver’s license in most of the US. That is, if you can get your hands on one.

The Aptera was initially slated for delivery “by 2021", and has now been pushed back to 2022. The company’s timeline calls for a finalized vehicle design by the end of this year, and a production rate of 10,000 units per year by the end of next December.

The company’s CEO, Chris Anthony, has no legal employment agreement with the company. Aptera explicitly states this in their SEC annual report, that he is forgoing traditional employment in favor of a 28.5% ownership stake in the company. While Anthony’s fifteen million shares of Aptera aren’t available to publicly trade, Aptera’s investor information lists a price per share of $8.80 — making Anthony’s share of the company worth an astounding $132,000,000, theoretically.

Aptera isn’t the only privately-traded company on the list, so it’s worth a brief explanation on how those work. You can still buy and sell shares of Aptera, but they aren’t subject to the market’s whims. They don’t fluctuate, they simply cost $8.80. If Chris Anthony were to liquidate his stock in the company, he’d earn every one of those hundred and thirty two million dollars. Assuming, of course, he could find a buyer — or a few.

Atlis Motor Vehicles

Atlis is developing the XT pickup truck to compete with Ford’s F-150Lightning, the Rivian R1T, and the Cybertruck. The company claims 500 miles of range, a 35,000-lbs towing capacity, and the ability to haul 5,000 lbs in the truck’s bed. The prototype is all hard angles and rough lines, but the production concept’s interior and exterior could pass for a real-life build of Cyberpunk 2077's Thorton Mackinaw.

Unfortunately, the XT pickup also seems to have adopted Cyberpunk’s years-delayed release schedule. In 2019, it was set for a 2020 release, which has now slid into 2022. With no press releases since July, there’s no telling if that date will fall further into the future.

Mark Hanchett, CEO and founder of Atlis, seems to have eschewed a salary in the company’s early days. He first earned a steady paycheck from the company in 2019, three years after its founding, when he earned $25,000. The following year, his pay skyrocketed to $180,384.85 for a total overall payout of $205,384.85.

His salary is a drop in the bucket, however, compared to his stock in the company. Hanchett owns 61% of Atlis, an incredible 11,284,583 shares. Like Aptera, those shares aren’t traded publicly, but earlier this year they were offered for $8.25/share to private investors. That puts Hanchett’s stake in Atlis at a wholly theoretical value of nearly ninety-three million dollars. His salary pushes him over the edge, to a grand total of $93,190,348.77.

Faraday Future

Faraday Future has the most exciting name on this list, and the most expensive car. The FF 91 will start at $180,000 when it hits the market, which is set to come next year. The final production car was meant to be revealed on an investor call earlier this week, but has been pushed back citing the COVID-19 pandemic.

Faraday Future’s CEO, Carsten Breitfeld, joined the company in 2019. Back then, he signed a three-year employment agreement entitling him to $2.25 million dollars per year. To sweeten the pot, Faraday Future threw in a $1.2 million signing bonus. If the FF 91 is pushed back beyond the end of 2022, Breitfeld will have raked in $7.95 million before a single car ever reaches customers.

Breitfeld’s employment agreement also includes provisions for a company car. If anyone out there knows what vehicles Faraday Future is supplying to its employees, please email me. I can’t get the curiosity out of my head.

Lordstown Motors

Lordstown Motors’ upcoming Endurance pickup is supposed to start production this month, and despite an incredibly tumultuous year they haven’t revised that timeline. We’ve seen near-production vehicles in the wild, but it’s yet to be seen if production will truly kick off in earnest so soon.

Lordstown’s recently-ousted CEO, Steve Burns, has an almost reasonable salary compared to Carsten Breitfeld. Burns’s initial employment agreement set out a $250,000/year salary, but his termination agreement gives him eighteen months of pay at double that rate. It’s unclear when his salary changed, making a running total difficult to calculate.

Conveniently, Burns owns enough stock to make a $250,000 uncertainty in his salary seem like a rounding error. He owns 26.25% of Lordstown Motors, with its 1.32 billion dollar market cap — netting him over fifty million dollars in theoretical equity alone.

Nikola

Nikola, the Theranos of the automotive world, is still signing contracts to deliver new zero-emissions semi trucks. Despite all their setbacks, the company’s share price has been climbing since August. It remains to be seen if the company will hit their production targets, but with their previous CEO out of the picture they’re still full steam ahead.

Trevor Milton, founder of Nikola, has the most complex payment plan on the list. His salary from the company was one dollar per year, but his employment agreement needed a spreadsheet to break down how Milton could earn stock based on Nikola’s performance.

To save you my headaches, I’ll sum up what happened: Based on Nikola’s stock performance, Trevor Milton was awarded over two and a half million shares of Nikola. This bonus helped fuel the staggering 91.6 million shares he had in his portfolio at the end of 2020.

In April and August of this year, Milton sold two batches of stock, netting him a collective $120.1 million. However, that’s only a fraction of his current equity in the company. Milton still holds approximately 72 million shares in Nikola, which at the time of writing are worth over a collective $820 million. Trevor Milton may never have made a working zero-emission truck, but he did make nearly a billion dollars.

Workhorse

Workhorse may be the saddest EV startup, but they’re the only company on this list to actually deliver a van — albeit briefly. The company will presumably resume deliveries on their C1000 van after the issues are remedied, but for now they’ve earned a spot in this article.

Workhorse recently got a new CEO by the name of Richard Dauch. He previously worked at Delphi, and Workhorse values his expertise at a cool million dollars a year to the company. If he can get vans back into the hands of customers, who knows, he might truly be worth it.

While many of these CEOs and founders earn their money in stock, only Steve Burns of Lordstown and Trevor Milton of Nikola have market-based share prices to contend with. The others have definite salaries or predetermined prices for privately-traded equity — far from the inflated, hypothetical valuations of some EV stocks.

We live in a time of unprecedented income inequality in the United States. High-earners continually see bigger and bigger raises, year over year, while the percentage of American wealth owned by low-income families drops. These CEOs, earn orders of magnitude more than workers who are physically putting cars together in plants where cars are actually made.

While EVs are clearly the future, it’s worth considering the way these startups have shaped our idea of executive pay at seemingly revolutionary companies. The next time you’re thinking of investing in a hot new EV competitor, be warned — you may simply be lining the CEO’s stock-option pockets.